Exam 20: Exchange Rate Crises: How Pegs Work and How They Break

Exam 1: Trade in the Global Economy135 Questions

Exam 2: Trade and Technology: The Ricardian Model202 Questions

Exam 3: Gains and Losses From Trade in the Specific-Factors Model148 Questions

Exam 4: Trade and Resources: the Heckscher-Ohlin Model138 Questions

Exam 5: Movement of Labor and Capital Between Countries159 Questions

Exam 6: Increasing Returns to Scale and Monopolistic Competition149 Questions

Exam 7: Offshoring of Goods and Services128 Questions

Exam 8: Import Tariffs and Quotas Under Perfect Competition183 Questions

Exam 9: Import Tariffs and Quotas Under Imperfect Competition201 Questions

Exam 10: Export Subsidies in Agriculture and High-Technology Industries155 Questions

Exam 11: International Agreements: Trade, Labor, and the Environment173 Questions

Exam 12: The Global Macroeconomy100 Questions

Exam 13: Introduction to Exchange Rates and the Foreign Exchange Market160 Questions

Exam 14: Exchange Rates I: the Monetary Approach in the Long Run161 Questions

Exam 15: Exchange Rates II: the Asset Approach in the Short Run159 Questions

Exam 16: National and International Accounts: Income, Wealth, and the Balance of Payments156 Questions

Exam 17: Balance of Payments I: the Gains From Financial Globalization153 Questions

Exam 18: Balance of Payments II: Output, Exchange Rates, and Macroeconomic Policies in the Short Run153 Questions

Exam 19: Fixed Versus Floating: International Monetary Experience182 Questions

Exam 20: Exchange Rate Crises: How Pegs Work and How They Break148 Questions

Exam 21: The Euro148 Questions

Exam 22: Topics in International Macroeconomics148 Questions

Select questions type

To maintain the peg, a nation must keep its circulating money supply constant. What factor(s) (in addition to its own actions) might result in a change in the money supply?

(Multiple Choice)

5.0/5  (34)

(34)

When a nation is maintaining an exchange rate peg, its money supply is typically backed by:

(Multiple Choice)

4.8/5  (45)

(45)

In general, when there is a large shock to domestic output, the government finds:

(Multiple Choice)

4.8/5  (35)

(35)

Uncovered interest parity may actually result in domestic interest rates being ____ than foreign rates because of investors' perceived risk of holding assets based in the domestic currency.

(Multiple Choice)

4.9/5  (27)

(27)

Which of the following is NOT likely to cause a money demand shock under a fixed exchange rate system?

(Multiple Choice)

4.8/5  (37)

(37)

A situation in which maintaining the peg could cause worse harms to the economy (such as high interest rates) may sway even prudent and cautious central bankers to abandon it. This situation is called:

(Multiple Choice)

4.8/5  (35)

(35)

El Salvador has dollarized; that is, it uses the U.S. dollar as its currency. What is the backing ratio for El Salvador's currency?

(Multiple Choice)

4.9/5  (31)

(31)

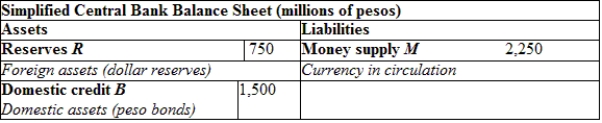

(Table: Mexico's Central Bank Balance Sheet) If the country sells 325 million pesos of foreign assets and issues domestic credit worth 425 million pesos, what will be the money supply in the economy?

(Multiple Choice)

4.8/5  (37)

(37)

Emerging markets and developing economies are more likely to want to maintain fixed exchange rates because of their dependence on exports. However, these regimes are often more difficult for them. Why?

(Short Answer)

4.8/5  (39)

(39)

From 2003 to 2009, the backing ratio for the Chinese economy rose to more than 100%. How did this happen?

(Multiple Choice)

4.7/5  (39)

(39)

In emerging markets, the reductions in growth of GDP as a result of exchange rate crises:

(Multiple Choice)

4.9/5  (31)

(31)

Why might a default crisis be associated with an exchange rate crisis?

(Multiple Choice)

4.9/5  (38)

(38)

Which of the following is the most likely use of foreign currency reserves?

(Multiple Choice)

4.8/5  (35)

(35)

The instruments with which central banks borrow reserves to increase the backing ratio to more than 100% are known as:

(Multiple Choice)

4.8/5  (39)

(39)

Financial crises tend to happen in pairs or triplets because:

(Multiple Choice)

4.7/5  (34)

(34)

The sudden collapse of a fixed exchange rate system is known as:

(Multiple Choice)

5.0/5  (35)

(35)

When analyzing problems in maintaining a fixed exchange rate system, simplifying assumptions must be made. Which of the following is NOT a simplifying assumption?

(Multiple Choice)

4.8/5  (37)

(37)

Among the solutions proposed for avoiding a foreign exchange crisis are all of the following, EXCEPT using:

(Multiple Choice)

4.9/5  (33)

(33)

Showing 61 - 80 of 148

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)