Exam 20: Forming and Operating Partnerships

Exam 1: An Introduction to Tax113 Questions

Exam 2: Tax Compliance, the IRS, and Tax Authorities112 Questions

Exam 3: Tax Planning Strategies and Related Limitations115 Questions

Exam 4: Individual Income Tax Overview, Dependents, and Filing Status125 Questions

Exam 5: Gross Income and Exclusions130 Questions

Exam 6: Individual Deductions98 Questions

Exam 7: Investments74 Questions

Exam 8: Individual Income Tax Computation and Tax Credits154 Questions

Exam 9: Business Income, Deductions, and Accounting Methods99 Questions

Exam 10: Property Acquisition and Cost Recovery109 Questions

Exam 11: Property Dispositions110 Questions

Exam 12: Compensation101 Questions

Exam 13: Retirement Savings and Deferred Compensation115 Questions

Exam 14: Tax Consequences of Home Ownership108 Questions

Exam 15: Entities Overview80 Questions

Exam 16: Corporate Operations109 Questions

Exam 17: Accounting for Income Taxes100 Questions

Exam 18: Corporate Taxation: Nonliquidating Distributions100 Questions

Exam 19: Corporate Formation, Reorganization, and Liquidation100 Questions

Exam 20: Forming and Operating Partnerships106 Questions

Exam 21: Dispositions of Partnership Interests and Partnership Distributions100 Questions

Exam 22: S Corporations134 Questions

Exam 23: State and Local Taxes117 Questions

Exam 24: The Us Taxation of Multinational Transactions89 Questions

Exam 25: Transfer Taxes and Wealth Planning123 Questions

Select questions type

On April 18, 20X8, Robert sold his 35 percent partnership interest in Fruit Wonder, LLC to Richard for $120,000. Prior to selling his interest, Robert had a basis in Fruit Wonder of $80,000. Robert's basis included $5,000 of recourse debt and $15,000 of nonrecourse debt that had been allocated to him. Immediately after the purchase, what is Richard's tax basis in Fruit Wonder?

(Essay)

4.8/5  (31)

(31)

The main difference between a partner's tax basis and at-risk amount is that qualified nonrecourse financing is not included in the at-risk basis amount.

(True/False)

4.8/5  (35)

(35)

Adjustments to a partner's outside basis are made annually to prevent double taxation on the sale of a partnership interest or at the time of a partnership distribution.

(True/False)

4.8/5  (43)

(43)

Which of the following statements regarding capital and profit interests received for services contributed to a partnership is false?

(Multiple Choice)

4.7/5  (31)

(31)

Greg, a 40% partner in GSS Partnership, contributed land to the partnership in exchange for his partnership interest when the partnership was formed. At the time, his basis in the land was $30,000 and its FMV was $133,000. Three years after the partnership was formed, GSS Partnership decided to sell the land to an unrelated party for $150,000. When the land is sold, how much of the gain should be allocated to each partner of GSS Partnership if Sam and Steve are each 30% partners?

(Essay)

4.9/5  (42)

(42)

What is the correct order for applying the following three items to adjust a partner's tax basis in his partnership interest: (1) Increase for share of ordinary business income, (2) Decrease for share of separately stated loss items, and (3) Decrease for distributions?

(Multiple Choice)

4.9/5  (29)

(29)

Nonrecourse debt is generally allocated according to the profit-sharing ratios of the partnership.

(True/False)

4.8/5  (35)

(35)

Erica and Brett decide to form their new motorcycle business as an LLC. Each will receive an equal profits (loss) interest by contributing cash, property, or both. In addition to the members' contributions, their LLC will obtain a $50,000 nonrecourse loan from First Bank at the time it is formed. Brett contributes cash of $5,000 and a building he bought as a storefront for the motorcycles. The building has a FMV of $45,000, an adjusted basis of $30,000, and is secured by a $35,000 nonrecourse mortgage that the LLC will assume. What is Brett's outside tax basis in his LLC interest?

(Multiple Choice)

4.7/5  (32)

(32)

Which of the following items are subject to the Net Investment Income tax when an individual partner is a material participant in the partnership?

(Multiple Choice)

4.8/5  (36)

(36)

If a taxpayer sells a passive activity with suspended passive activity losses from prior years, what type of income can be offset by the suspended passive losses in the year of sale?

(Multiple Choice)

4.7/5  (40)

(40)

Partnerships can use special allocations to shift built-in gains and built-in losses on contributed property from a partner who contributed the property to other partners.

(True/False)

4.9/5  (40)

(40)

What is the difference between the aggregate and entity theory of partnership taxation? Provide two examples of how partnership tax rules reflect the aggregate theory and two examples of how they reflect the entity theory.

(Essay)

4.8/5  (41)

(41)

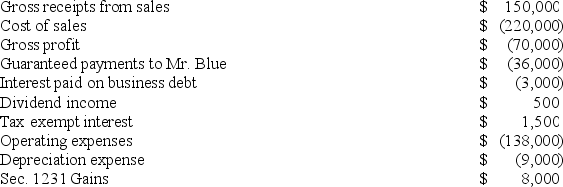

On January 1, 20X9, Mr. Blue and Mr. Grey each contributed $100,000 to form the B&G general partnership. Their partnership agreement states that they will each receive a 50% profits and loss interest. The partnership agreement also provides that Mr. Blue will receive an annual $36,000 guaranteed payment. B&G began business on January 1, 20X9. For its first taxable year, its accounting records contained the following information:

The $3,000 of interest was paid on a $60,000 loan made to B&G by Key Bank on June 30, 20X9. B&G repaid $10,000 of the loan on December 15, 20X9. Neither of the partners received a cash distribution from B&G in 20X9.

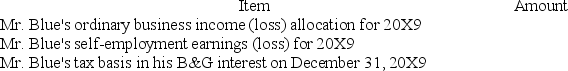

Complete the following table related to Mr. Blue's interest in B&G partnership:

The $3,000 of interest was paid on a $60,000 loan made to B&G by Key Bank on June 30, 20X9. B&G repaid $10,000 of the loan on December 15, 20X9. Neither of the partners received a cash distribution from B&G in 20X9.

Complete the following table related to Mr. Blue's interest in B&G partnership:

(Essay)

4.8/5  (34)

(34)

The term "outside basis" refers to the partnership's basis in its assets; whereas, the term "inside basis" refers an individual partner's basis in her partnership interest.

(True/False)

4.7/5  (44)

(44)

Which of the following statements is true when property is contributed in exchange for a partnership interest?

(Multiple Choice)

4.8/5  (37)

(37)

Clint noticed that the Schedule K-1 he just received from ABC Partnership included a $20,000 ordinary business loss allocation. His tax basis in ABC at the beginning of ABC's most recent tax year was $10,000. Comparing the Schedule K-1 he recently received from ABC with the Schedule K-1 he received from ABC last year, Clint noted that his share of ABC partnership debt changed as follows: recourse debt increased from $0 to $2,000, qualified nonrecourse debt increased from $0 to $3,000, and nonrecourse debt increased from $0 to $3,000. Finally, the Schedule K-1 Clint recently received from ABC reflected a $1,000 cash contribution he made to ABC during the year.

Clint is not a material participant in ABC partnership, and he received $10,000 of passive income from another investment during the same year he received the loss allocation from ABC. How much of the $20,000 loss from ABC can Clint deduct currently, and how much of the loss is suspended because of the tax basis, the at-risk, and the passive activity loss limitations?

(Essay)

4.7/5  (29)

(29)

The character of each separately stated item is determined at the partner level.

(True/False)

4.9/5  (41)

(41)

Which requirement must be satisfied in order to specially allocate partnership income or losses to partners?

(Multiple Choice)

4.8/5  (24)

(24)

Under proposed regulations issued by the Treasury Department, in which of the following situations should an LLC member be treated as a general partner for self-employment tax purposes?

(Multiple Choice)

4.9/5  (30)

(30)

XYZ, LLC has several individual and corporate members. Abe and Joe, individuals with 4/30 year-ends, each have a 23% profits and capital interest. RST, Inc., a corporation with a 6/30 year end, owns a 4% profits and capital interest while DEF, Inc., a corporation with an 8/30 year end, owns a 4.9% profits and capital interest. Finally, thirty other calendar year-end individual partners (each with less than a 2% profits and capital interest) own the remaining 45% of the profits and capital interests in XYZ. What tax year-end should XYZ use and which test or rule requires this year-end?

(Multiple Choice)

4.9/5  (34)

(34)

Showing 61 - 80 of 106

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)