Exam 20: Forming and Operating Partnerships

Exam 1: An Introduction to Tax113 Questions

Exam 2: Tax Compliance, the IRS, and Tax Authorities112 Questions

Exam 3: Tax Planning Strategies and Related Limitations115 Questions

Exam 4: Individual Income Tax Overview, Dependents, and Filing Status125 Questions

Exam 5: Gross Income and Exclusions130 Questions

Exam 6: Individual Deductions98 Questions

Exam 7: Investments74 Questions

Exam 8: Individual Income Tax Computation and Tax Credits154 Questions

Exam 9: Business Income, Deductions, and Accounting Methods99 Questions

Exam 10: Property Acquisition and Cost Recovery109 Questions

Exam 11: Property Dispositions110 Questions

Exam 12: Compensation101 Questions

Exam 13: Retirement Savings and Deferred Compensation115 Questions

Exam 14: Tax Consequences of Home Ownership108 Questions

Exam 15: Entities Overview80 Questions

Exam 16: Corporate Operations109 Questions

Exam 17: Accounting for Income Taxes100 Questions

Exam 18: Corporate Taxation: Nonliquidating Distributions100 Questions

Exam 19: Corporate Formation, Reorganization, and Liquidation100 Questions

Exam 20: Forming and Operating Partnerships106 Questions

Exam 21: Dispositions of Partnership Interests and Partnership Distributions100 Questions

Exam 22: S Corporations134 Questions

Exam 23: State and Local Taxes117 Questions

Exam 24: The Us Taxation of Multinational Transactions89 Questions

Exam 25: Transfer Taxes and Wealth Planning123 Questions

Select questions type

A partner's tax basis or at-risk amount can be increased by making capital contributions, by paying off partnership debt, or by increasing the profitability of the partnership.

(True/False)

4.8/5  (38)

(38)

Does adjusting a partner's basis for tax-exempt income prevent double taxation?

(Multiple Choice)

4.8/5  (35)

(35)

If a partner participates in partnership activities on a regular, continuous, and substantial basis, then the partnership's activities with respect to this individual partner are not considered passive.

(True/False)

4.8/5  (38)

(38)

In what order should the tests to determine a partnership's year end be applied?

(Multiple Choice)

4.9/5  (39)

(39)

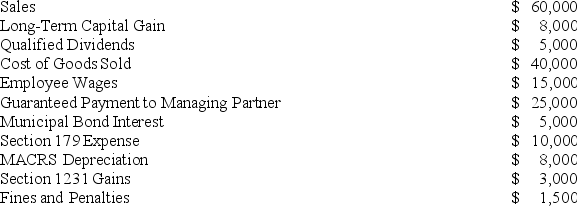

Illuminating Light Partnership had the following revenues, expenses, gains, losses, and distributions:

Given these items, what is Illuminating Light's ordinary business income (loss) for the year?

Given these items, what is Illuminating Light's ordinary business income (loss) for the year?

(Essay)

4.7/5  (34)

(34)

Which of the following items will affect a partner's tax basis?

(Multiple Choice)

4.9/5  (36)

(36)

Zinc, LP was formed on August 1, 20X9. When the partnership was formed, Al contributed $10,000 in cash and inventory with a FMV and tax basis of $40,000. In addition, Bill contributed equipment with a FMV of $30,000 and adjusted basis of $25,000 along with accounts receivable with a FMV and tax basis of $20,000. Also, Chad contributed land with a FMV of $50,000 and tax basis of $35,000. Finally, Dave contributed a machine, secured by $35,000 of debt, with a FMV of $15,000 and a tax basis of $10,000. What is the total inside basis of all the assets contributed to Zinc, LP?

(Multiple Choice)

4.8/5  (36)

(36)

Which of the following items are subject to the Net Investment Income tax when a partner is not a material participant in the partnership?

(Multiple Choice)

4.8/5  (39)

(39)

Sarah, Sue, and AS Inc. formed a partnership on May 1, 20X9 called SSAS, LP. Now that the partnership is formed, they must determine its appropriate year-end. Sarah has a 30% profits and capital interest while Sue has a 35% profits and capital interest. Both Sarah and Sue have calendar year-ends. AS Inc. holds the remaining profits and capital interest in the LP, and it has a September 30 year-end. What tax year-end must SSAS, LP use for 20X9 and which test or rule requires this year-end?

(Multiple Choice)

4.9/5  (39)

(39)

Which of the following statements exemplifies the entity theory of partnership taxation?

(Multiple Choice)

4.9/5  (40)

(40)

On January 1, X9, Gerald received his 50% profits and capital interest in High Air, LLC in exchange for $2,000 in cash and real property with a $3,000 tax basis secured by a $2,000 nonrecourse mortgage. High Air reported a $15,000 loss for its X9 calendar year. How much loss can Gerald deduct, and how much loss must he suspend if he only applies the tax basis loss limitation?

(Multiple Choice)

4.9/5  (35)

(35)

A partnership with a C corporation partner must always use the accrual method as its accounting method.

(True/False)

4.8/5  (28)

(28)

A partner's self-employment earnings (loss) may be affected by her share of ordinary business income (loss) and any guaranteed payments she receives. The impact of these amounts typically depends on the status of the partner. Which of the following statements correctly describes the effect these items have on the partner's self-employment earnings (loss)?

(Multiple Choice)

4.9/5  (42)

(42)

Which of the following entities is not considered a flow-through entity?

(Multiple Choice)

4.9/5  (36)

(36)

A partnership can elect to amortize organization and startup costs; however, syndication costs are not deductible.

(True/False)

4.8/5  (35)

(35)

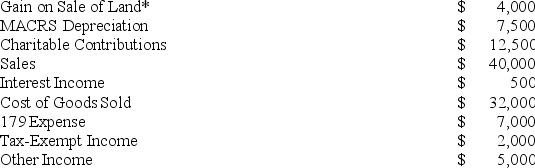

ER General Partnership, a medical supplies business, states in its partnership agreement that Erin and Ryan agree to split profits and losses according to a 40/60 ratio. Additionally, the partnership will provide Erin with a $15,000 guaranteed payment for services she provides to the partnership. ER Partnership reports the following revenues, expenses, gains, losses, and distributions for its current taxable year:

*The Land is a Section 1231 asset

Given these items, answer the following questions:

A. Compute Erin's share of ordinary income (loss) and separately-stated items. Include her self-employment income as a separately-stated item.

B. Compute Erin's self-employment income, except assume ER Partnership is a limited partnership and Erin is a limited partner.

C. Compute Erin's self-employment income, except assume ER Partnership is an LLC and Erin is personally liable for half of the debt of the LLC. Apply the IRS's proposed regulations in formulating your answer.

*The Land is a Section 1231 asset

Given these items, answer the following questions:

A. Compute Erin's share of ordinary income (loss) and separately-stated items. Include her self-employment income as a separately-stated item.

B. Compute Erin's self-employment income, except assume ER Partnership is a limited partnership and Erin is a limited partner.

C. Compute Erin's self-employment income, except assume ER Partnership is an LLC and Erin is personally liable for half of the debt of the LLC. Apply the IRS's proposed regulations in formulating your answer.

(Essay)

4.7/5  (32)

(32)

Any losses that exceed the tax basis of a partner in their partnership interest are suspended and carried forward for 20 years.

(True/False)

4.8/5  (40)

(40)

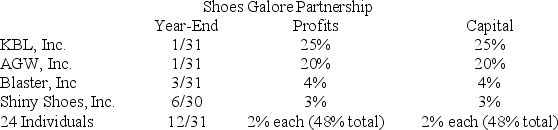

KBL, Inc., AGW, Inc., Blaster, Inc., Shiny Shoes, Inc., and a group of 24 individuals form Shoes Galore General Partnership on October 11, 20X9. Now, Shoes Galore must adopt its required tax year-end. The partners' year-ends, profits interests, and capital interests are reflected in the table below. Given this information, what tax year-end must Shoes Galore use and what rule requires this year-end?

(Essay)

4.8/5  (32)

(32)

Which of the following statements regarding partnerships losses suspended by the tax basis limitation is true?

(Multiple Choice)

4.8/5  (34)

(34)

Which person would generally be treated as a material participant in an activity?

(Multiple Choice)

4.8/5  (43)

(43)

Showing 41 - 60 of 106

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)