Exam 4: Individual Income Tax Overview, Dependents, and Filing Status

Exam 1: An Introduction to Tax113 Questions

Exam 2: Tax Compliance, the IRS, and Tax Authorities112 Questions

Exam 3: Tax Planning Strategies and Related Limitations115 Questions

Exam 4: Individual Income Tax Overview, Dependents, and Filing Status125 Questions

Exam 5: Gross Income and Exclusions130 Questions

Exam 6: Individual Deductions98 Questions

Exam 7: Investments74 Questions

Exam 8: Individual Income Tax Computation and Tax Credits154 Questions

Exam 9: Business Income, Deductions, and Accounting Methods99 Questions

Exam 10: Property Acquisition and Cost Recovery109 Questions

Exam 11: Property Dispositions110 Questions

Exam 12: Compensation101 Questions

Exam 13: Retirement Savings and Deferred Compensation115 Questions

Exam 14: Tax Consequences of Home Ownership108 Questions

Exam 15: Entities Overview80 Questions

Exam 16: Corporate Operations109 Questions

Exam 17: Accounting for Income Taxes100 Questions

Exam 18: Corporate Taxation: Nonliquidating Distributions100 Questions

Exam 19: Corporate Formation, Reorganization, and Liquidation100 Questions

Exam 20: Forming and Operating Partnerships106 Questions

Exam 21: Dispositions of Partnership Interests and Partnership Distributions100 Questions

Exam 22: S Corporations134 Questions

Exam 23: State and Local Taxes117 Questions

Exam 24: The Us Taxation of Multinational Transactions89 Questions

Exam 25: Transfer Taxes and Wealth Planning123 Questions

Select questions type

The character of income is a factor in determining the rate at which the income is taxed.

(True/False)

4.9/5  (34)

(34)

To determine filing status, a taxpayer's marital status is determined on January 1 of each tax year in question.

(True/False)

4.8/5  (36)

(36)

A taxpayer may qualify for the head of household filing status if she has no dependent children but pays more than half of the cost of maintaining a separate household for her dependent mother and/or father.

(True/False)

4.9/5  (38)

(38)

Certain types of income are taxed at a lower rate than ordinary income.

(True/False)

4.8/5  (38)

(38)

Catherine de Bourgh has one child, Anne, who is 18 years old at the end of the year. Anne lived at home for seven months during the year before leaving home to attend State University for the rest of the year. During the year, Anne earned $6,000 while working part time. Catherine provided 80 percent of Anne's support and Anne provided the rest. Which of the following statements regarding whether Anne is Catherine's qualifying child for the current year is correct?

(Multiple Choice)

4.8/5  (36)

(36)

From AGI deductions are commonly referred to as deductions "below the line."

(True/False)

4.9/5  (34)

(34)

Taxpayers who file as qualifying widows/widowers are treated the same for tax purposes in all respects as taxpayers who are married filing jointly for tax purposes.

(True/False)

5.0/5  (42)

(42)

Which of the following statements regarding tax credits is true?

(Multiple Choice)

4.8/5  (36)

(36)

In June of year 1, Jake's wife Darla died. The couple did not have any children and Jake did not remarry in year 1 or year 2. Which is the most favorable filing status for Jake in year 2?

(Multiple Choice)

4.8/5  (36)

(36)

Which of the following statements regarding for AGI tax deductions is true?

(Multiple Choice)

4.8/5  (34)

(34)

If a taxpayer does not provide more than half the support of a child, that child cannot qualify as the taxpayer's qualifying child.

(True/False)

5.0/5  (35)

(35)

In June of year 1, Edgar's wife Cathy died and Edgar did not remarry during the year. What is his filing status for year 1 (assuming they did not have any dependents)?

(Multiple Choice)

4.9/5  (35)

(35)

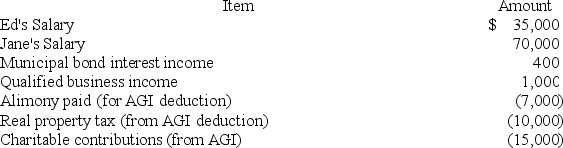

Jane and Ed Rochester are married with a two-year-old child who lives with them and whom they support financially. In 2018, Ed and Jane realized the following items of income and expense:

They also qualified for a $2,000 child tax credit. Their employers withheld $5,800 in federal income taxes from their paychecks (in the aggregate). Finally, the 2018 standard deduction amount for MFJ taxpayers is $24,000.

What are the couple's taxes due or tax refund (use the tax rate schedules not tax tables)?

They also qualified for a $2,000 child tax credit. Their employers withheld $5,800 in federal income taxes from their paychecks (in the aggregate). Finally, the 2018 standard deduction amount for MFJ taxpayers is $24,000.

What are the couple's taxes due or tax refund (use the tax rate schedules not tax tables)?

(Essay)

4.8/5  (40)

(40)

Which of the following statements regarding exclusions and/or deferrals is false?

(Multiple Choice)

4.8/5  (43)

(43)

For AGI deductions are commonly referred to as deductions "below the line."

(True/False)

5.0/5  (46)

(46)

Jeremy and Annie are married. During the year Jeremy dies. When Annie files her tax return for the year in which her husband dies, she may file under the married filing jointly filing status even if she does not remarry.

(True/False)

4.8/5  (38)

(38)

Tom Suzuki's tax liability for the year is $2,450. He had $2,050 of federal income taxes withheld from his paycheck during the year by his employer and has $2,000 in tax credits. What are Tom's taxes due or tax refund for the year?

(Essay)

5.0/5  (36)

(36)

In order to be a qualifying relative of another, an individual's gross income must be less than ________.

(Multiple Choice)

4.8/5  (37)

(37)

Showing 81 - 100 of 125

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)