Multiple Choice

Page & Seed scenario:

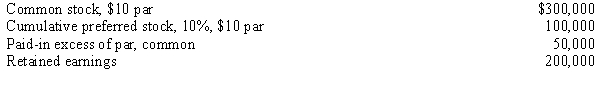

Page Company purchased an 80% interest in the common stock of the Seed Company for $600,000 on January 1, 20X4, when Seed Company had the following stockholders' equity:

Any excess of cost over book value on the common stock purchase was attributed to goodwill. Page does not hold any of Seed's preferred stock. Seed had net income of $40,000 during 20X4 and paid no dividends.

Any excess of cost over book value on the common stock purchase was attributed to goodwill. Page does not hold any of Seed's preferred stock. Seed had net income of $40,000 during 20X4 and paid no dividends.

-Refer to Page and Seed. The preferred stock is 1 year in arrears on January 1, 20X4. The goodwill that will appear on the consolidated balance sheet prepared on January 1, 20X4, is ____.

A) $80,000

B) $88,000

C) $210,000

D) $168,000

Correct Answer:

Verified

Correct Answer:

Verified

Q2: Pilatte Company acquired a 90% interest in

Q4: On January 1, 20X1, Parent Company

Q6: Page & Seed scenario:<br>Page Company purchased an

Q7: Pine & Scent scenario:<br>Pine Company purchased a

Q10: Company P has consistently sold merchandise for

Q11: When a parent sells its subsidiary interest,

Q25: Company P owns an 90% interest in

Q33: Parent has purchased additional shares of subsidiary

Q35: Which of the following statements is incorrect

Q37: Control of a subsidiary was achieved with