Essay

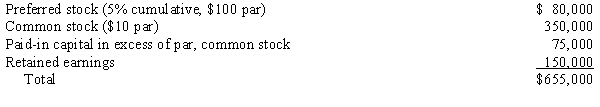

Pilatte Company acquired a 90% interest in the common stock of Sweet Company for $630,000 on January 1, 20X3, when Sweet Company had the following stockholders' equity:

The preferred stock dividends are 2 years in arrears. Any excess is attributable to equipment with a 6-year life, which is undervalued by $40,000, and to goodwill.

The preferred stock dividends are 2 years in arrears. Any excess is attributable to equipment with a 6-year life, which is undervalued by $40,000, and to goodwill.

Required:

Prepare a determination and distribution of excess schedule for the investment in Sweet Company.

Correct Answer:

Verified

Correct Answer:

Verified

Q4: On January 1, 20X1, Parent Company

Q5: Page & Seed scenario:<br>Page Company purchased an

Q6: Page & Seed scenario:<br>Page Company purchased an

Q7: Pine & Scent scenario:<br>Pine Company purchased a

Q10: Company P has consistently sold merchandise for

Q11: When a parent sells its subsidiary interest,

Q25: Company P owns an 90% interest in

Q33: Parent has purchased additional shares of subsidiary

Q35: Which of the following statements is incorrect

Q37: Control of a subsidiary was achieved with