Multiple Choice

Scenario 10-1

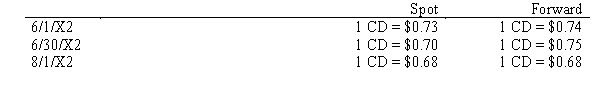

On 6/1/X2, an American firm purchased a inventory costing 100,000 Canadian Dollars from a Canadian firm to be paid for on 8/1/X2. Also on 6/1/X2, the American firm entered into a forward contract to purchase 100,000 Canadian dollars for delivery on 8/1/X2. The exchange rates were as follows:

The American firms fiscal year end is 6/30/X2. The changes in the value of the forward contract should be discounted at 8%.

The American firms fiscal year end is 6/30/X2. The changes in the value of the forward contract should be discounted at 8%.

-Refer to Scenario 10-1. What is the value of the Forward Contract Receivable-FC on 6/1/X2?

A) $73,000

B) $74,000

C) $68,000

D) $70,000

Correct Answer:

Verified

Correct Answer:

Verified

Q22: Wild, Inc. sold merchandise for 500,000 FC

Q23: On November 1, 20X2, a calendar-year investor

Q24: On January 1, 20X1, a domestic firm

Q25: Happ, Inc. agreed to purchase merchandise from

Q26: Lion Corporation, a U.S. firm, entered into

Q29: Blue & Green, Inc. purchased merchandise

Q30: Which of the following factors influences the

Q31: On January 1, 20X1, a U.S. firm

Q32: Wolters Corporation is a U.S. corporation

Q38: The accounting treatment given a cash flow