Essay

Lion Corporation, a U.S. firm, entered into several foreign currency transactions during the year. Determine the effect of each transaction on net income for that current accounting year only. Bear has a June 30 year end.

Required:

a.

On January 15, Lion sold $30,000 (Canadian) in merchandise to a Canadian firm, to be paid for on February 15 in Canadian dollars. Canadian dollars were worth $0.85 (U.S.) on January 15 and $0.82 (U.S.) on February 15.

b.

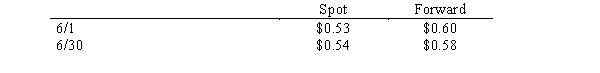

On June 1, Lion purchased and received a computer costing 100,000 euros from a German firm. Bear paid for the computer on August 1. On June 1, to reduce exchange risks, Lion purchased a contract to buy 100,000 marks in 60 days. Exchange rates are as follows:

Discount rate = 6%

Discount rate = 6%

c.

On June 1, Lion purchased an option to sell 100,000 FC in 60 days to hedge a forecasted sale to a customer. The option sold for a premium of $6,500 and a strike price of $1.20. The value of the option 6/30 was $12,500. The spot rate on June 1 was $1.19 and $1.25 on June 30.

Correct Answer:

Verified

Correct Answer:

Verified

Q21: Explain how the risks differ for holders

Q22: Wild, Inc. sold merchandise for 500,000 FC

Q23: On November 1, 20X2, a calendar-year investor

Q24: On January 1, 20X1, a domestic firm

Q25: Happ, Inc. agreed to purchase merchandise from

Q27: Scenario 10-1<br>On 6/1/X2, an American firm purchased

Q29: Blue & Green, Inc. purchased merchandise

Q30: Which of the following factors influences the

Q31: On January 1, 20X1, a U.S. firm

Q38: The accounting treatment given a cash flow