Multiple Choice

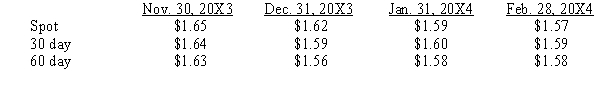

Happ, Inc. agreed to purchase merchandise from a British vendor on November 30, 20X3. The goods will arrive on January 31, 20X4 and payment of 100,000 British pounds is due February 28, 20X4. On November 30, 20X3, Happ signed an agreement with a foreign exchange broker to buy 100,000 British pounds on February 28, 20X4. Exchange rates to purchase 1 British pound are as follows:  Because of this commitment hedge, Happ, Inc. will record the merchandise at what value when it arrives in January?

Because of this commitment hedge, Happ, Inc. will record the merchandise at what value when it arrives in January?

A) $165,000

B) $164,000

C) $160,000

D) $159,000

Correct Answer:

Verified

Correct Answer:

Verified

Q21: Explain how the risks differ for holders

Q22: Wild, Inc. sold merchandise for 500,000 FC

Q23: On November 1, 20X2, a calendar-year investor

Q24: On January 1, 20X1, a domestic firm

Q26: Lion Corporation, a U.S. firm, entered into

Q27: Scenario 10-1<br>On 6/1/X2, an American firm purchased

Q29: Blue & Green, Inc. purchased merchandise

Q30: Which of the following factors influences the

Q38: The accounting treatment given a cash flow

Q39: Which of the following does not represent