Multiple Choice

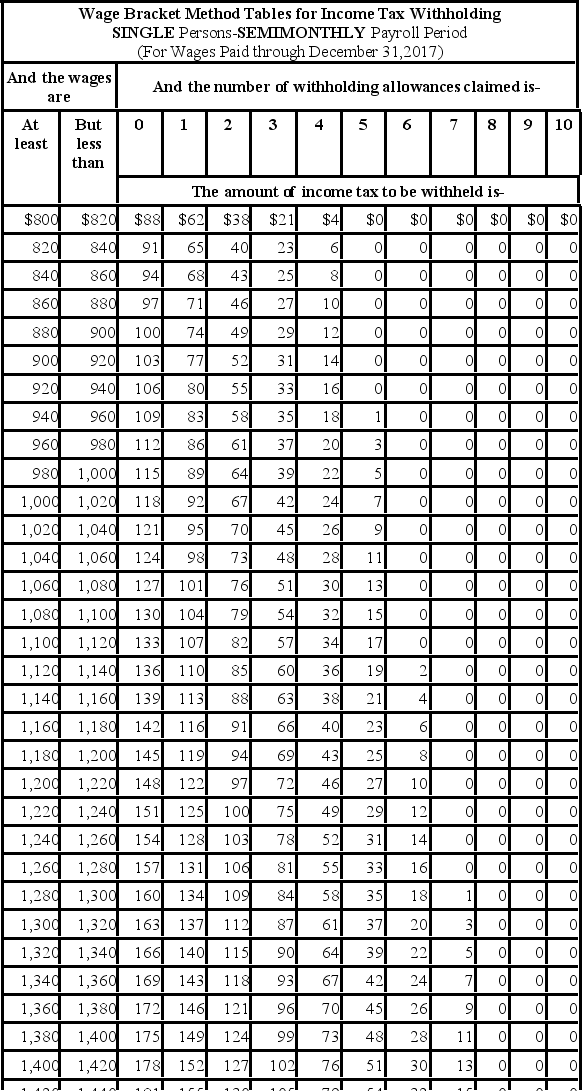

Julio is single with 1 withholding allowance. He earned $1,025.00 during the most recent semimonthly pay period. He needs to decide between contributing 3% and $30 to his 401(k) plan. If he chooses the method that results in the lowest taxable income, how much will be withheld for Federal income tax (based on the following table) ?

A) $77.00

B) $86.00

C) $92.00

D) Both yield the same tax amount

Correct Answer:

Verified

Correct Answer:

Verified

Q2: When a payroll check is subject to

Q6: The use of paycards as a means

Q8: Why might an employee elect to have

Q9: Collin is a full-time exempt employee in

Q20: Computation of net pay involves deducting mandatory

Q25: What role does the employer play regarding

Q28: The annual payroll tax guide that the

Q45: What payroll-specific tool is used to facilitate

Q47: The purpose of the wage base used

Q61: Why do employers use checks as an