Multiple Choice

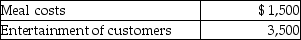

Steven is a representative for a textbook publishing company. Steven attends a convention which will also be attended by many potential customers. During the week of the convention, Steven incurs the following costs in entertaining potential customers.  Having recently been to a company seminar on the new tax laws, Steven makes sure that business is discussed at the various dinners, and that the entertainment is on the same day as the meetings with customers. Steven is reimbursed $2,000 by his employer under an accountable plan. Steven's AGI for the year is $50,000, and while he itemizes deductions, he has no other miscellaneous itemized deductions. What is the amount and character of Steven's deduction after any limitations?

Having recently been to a company seminar on the new tax laws, Steven makes sure that business is discussed at the various dinners, and that the entertainment is on the same day as the meetings with customers. Steven is reimbursed $2,000 by his employer under an accountable plan. Steven's AGI for the year is $50,000, and while he itemizes deductions, he has no other miscellaneous itemized deductions. What is the amount and character of Steven's deduction after any limitations?

A) $500 from AGI

B) $500 for AGI

C) $2,000 from AGI

D) $2,000 for AGI

Correct Answer:

Verified

Correct Answer:

Verified

Q15: Kim currently lives in Buffalo and works

Q34: Nonqualified deferred compensation plans can discriminate in

Q55: In-home office expenses for an office used

Q66: A partnership plans to set up a

Q119: If an individual is not "away from

Q125: Bill obtained a new job in Boston.

Q132: Edward incurs the following moving expenses: <img

Q151: If an employee incurs business-related entertainment expenses

Q1326: Gina is an instructor at State University

Q1743: Discuss the tax treatment of a nonqualified