Multiple Choice

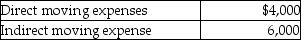

Edward incurs the following moving expenses:  The employer reimburses Edward for the full $10,000. What is the amount to be reported as income by Edward?

The employer reimburses Edward for the full $10,000. What is the amount to be reported as income by Edward?

A) $0

B) $4,000

C) $6,000

D) $10,000

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q13: An employer receives an immediate tax deduction

Q15: Kim currently lives in Buffalo and works

Q34: Nonqualified deferred compensation plans can discriminate in

Q55: In-home office expenses for an office used

Q119: If an individual is not "away from

Q125: Bill obtained a new job in Boston.

Q129: Steven is a representative for a textbook

Q151: If an employee incurs business-related entertainment expenses

Q1326: Gina is an instructor at State University

Q1743: Discuss the tax treatment of a nonqualified