Multiple Choice

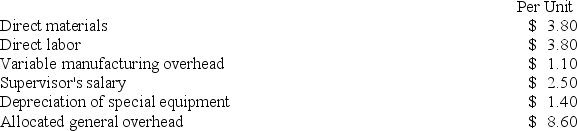

Rebelo Corporation is presently making part E07 that is used in one of its products. A total of 17,000 units of this part are produced and used every year. The company's Accounting Department reports the following costs of producing the part at this level of activity:  An outside supplier has offered to make and sell the part to the company for $20.80 each. If this offer is accepted, the supervisor's salary and all of the variable costs, including direct labor, can be avoided. The special equipment used to make the part was purchased many years ago and has no salvage value or other use. The allocated general overhead represents fixed costs of the entire company, none of which would be avoided if the part were purchased instead of produced internally. If management decides to buy part E07 from the outside supplier rather than to continue making the part, what would be the annual impact on the company's overall net operating income?

An outside supplier has offered to make and sell the part to the company for $20.80 each. If this offer is accepted, the supervisor's salary and all of the variable costs, including direct labor, can be avoided. The special equipment used to make the part was purchased many years ago and has no salvage value or other use. The allocated general overhead represents fixed costs of the entire company, none of which would be avoided if the part were purchased instead of produced internally. If management decides to buy part E07 from the outside supplier rather than to continue making the part, what would be the annual impact on the company's overall net operating income?

A) ($6,800)

B) ($163,200)

C) $163,200

D) $6,800

Correct Answer:

Verified

Correct Answer:

Verified

Q165: Younes Inc. manufactures industrial components. One of

Q166: Benjamin Company produces products C, J, and

Q167: Sharp Corporation produces 8,000 parts each year,

Q168: Penagos Corporation is presently making part Z43

Q170: Sardi Inc. is considering whether to continue

Q171: Bruce Corporation makes four products in a

Q172: Ahrends Corporation makes 70,000 units per year

Q173: Consider the following production and cost data

Q174: Ouzts Corporation is considering Alternative A and

Q267: The Wyeth Corporation produces three products, A,