Multiple Choice

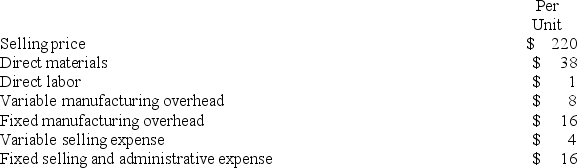

Younes Inc. manufactures industrial components. One of its products, which is used in the construction of industrial air conditioners, is known as P06. Data concerning this product are given below:  The above per unit data are based on annual production of 4,000 units of the component. Assume that direct labor is a variable cost.

The above per unit data are based on annual production of 4,000 units of the component. Assume that direct labor is a variable cost.

The company has received a special, one-time-only order for 400 units of component P06. There would be no variable selling expense on this special order and the total fixed manufacturing overhead and fixed selling and administrative expenses of the company would not be affected by the order. Assuming that Younes has excess capacity and can fill the order without cutting back on the production of any product, what is the minimum price per unit below which the company should not accept the special order?

A) $47 per unit

B) $83 per unit

C) $63 per unit

D) $220 per unit

Correct Answer:

Verified

Correct Answer:

Verified

Q110: Lusk Corporation produces and sells 10,000 units

Q160: Bertucci Corporation makes three products that use

Q162: The SP Corporation makes 40,000 motors to

Q163: Key Corporation is considering the addition of

Q166: Benjamin Company produces products C, J, and

Q167: Sharp Corporation produces 8,000 parts each year,

Q168: Penagos Corporation is presently making part Z43

Q169: Rebelo Corporation is presently making part E07

Q170: Sardi Inc. is considering whether to continue

Q267: The Wyeth Corporation produces three products, A,