Multiple Choice

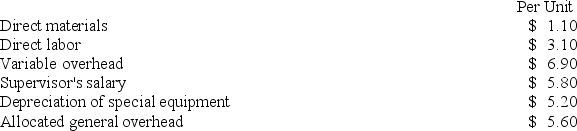

Penagos Corporation is presently making part Z43 that is used in one of its products. A total of 5,000 units of this part are produced and used every year. The company's Accounting Department reports the following costs of producing the part at this level of activity:  An outside supplier has offered to produce and sell the part to the company for $20.80 each. If this offer is accepted, the supervisor's salary and all of the variable costs, including direct labor, can be avoided. The special equipment used to make the part was purchased many years ago and has no salvage value or other use. The allocated general overhead represents fixed costs of the entire company. If the outside supplier's offer were accepted, only $4,000 of these allocated general overhead costs would be avoided.

An outside supplier has offered to produce and sell the part to the company for $20.80 each. If this offer is accepted, the supervisor's salary and all of the variable costs, including direct labor, can be avoided. The special equipment used to make the part was purchased many years ago and has no salvage value or other use. The allocated general overhead represents fixed costs of the entire company. If the outside supplier's offer were accepted, only $4,000 of these allocated general overhead costs would be avoided.

If management decides to buy part Z43 from the outside supplier rather than to continue making the part, what would be the annual financial advantage (disadvantage) ?

A) ($34,500)

B) ($30,500)

C) ($15,500)

D) ($38,500)

Correct Answer:

Verified

Correct Answer:

Verified

Q163: Key Corporation is considering the addition of

Q165: Younes Inc. manufactures industrial components. One of

Q166: Benjamin Company produces products C, J, and

Q167: Sharp Corporation produces 8,000 parts each year,

Q169: Rebelo Corporation is presently making part E07

Q170: Sardi Inc. is considering whether to continue

Q171: Bruce Corporation makes four products in a

Q172: Ahrends Corporation makes 70,000 units per year

Q173: Consider the following production and cost data

Q267: The Wyeth Corporation produces three products, A,