Essay

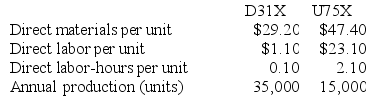

Bullie Manufacturing Corporation has a traditional costing system in which it applies manufacturing overhead to its products using a predetermined overhead rate based on direct labor-hours (DLHs). The company has two products, D31X and U75X, about which it has provided the following data:

The company's estimated total manufacturing overhead for the year is $1,147,650 and the company's estimated total direct labor-hours for the year is 35,000.

The company's estimated total manufacturing overhead for the year is $1,147,650 and the company's estimated total direct labor-hours for the year is 35,000.

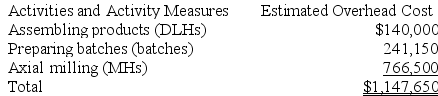

The company is considering using a variation of activity-based costing to determine its unit product costs for external reports. Data for this proposed activity-based costing system appear below:

Required:

Required:

a. Determine the manufacturing overhead cost per unit of each of the company's two products under the traditional costing system.

b. Determine the manufacturing overhead cost per unit of each of the company's two products under activity-based costing system.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Poma Manufacturing Corporation has a traditional costing

Q3: Coudriet Manufacturing Corporation has a traditional costing

Q4: Look Manufacturing Corporation has a traditional costing

Q5: Njombe Corporation manufactures a variety of products.

Q6: Njombe Corporation manufactures a variety of products.

Q7: Adelberg Corporation makes two products: Product A

Q8: Cabigas Corporation manufactures two products, Product

Q9: Werger Manufacturing Corporation has a traditional costing

Q10: Torri Manufacturing Corporation has a traditional costing

Q11: Welk Manufacturing Corporation has a traditional costing