Essay

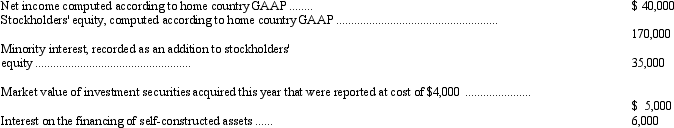

The following financial information is for DC Company, a non-U.S. firm with shares listed on a U.S. stock exchange:

If DC Company were following U.S. GAAP, the minority interest would have been classified as a liability instead of as part of stockholders' equity. In addition, minority interest income of $4,000 for the year would have been excluded from the computation of net income. Under U.S. GAAP the investment securities would have been classified as trading securities and the interest on financing of self-constructed assets would have been capitalized rather than expensed.

Prepare reconciliations of DC's reported stockholders' equity and net income to U.S. GAAP.

Correct Answer:

Verified

Correct Answer:

Verified

Q3: Domingo Company, a U.S. company, owns a

Q5: Northern Metalworks, Inc., purchased Canadian Metal Products,

Q6: Which of the following is true regarding

Q8: Sarkozy Enterprises, a subsidiary of Obama Company

Q9: Under international accounting standards, the derecognition of

Q10: Rome Enterprises, a subsidiary of La Italia

Q11: Under international accounting standards,cash paid for interest

Q11: The following financial information is for Olaf

Q16: Under international accounting standards,the pension-related asset or

Q29: Current generally accepted accounting principles require that