Multiple Choice

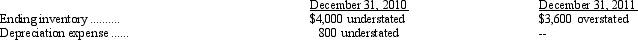

Rodney Company's December 31 year-end financial statements contained the following errors:

An insurance premium of $3,600 was prepaid in 2010 covering the years 2010, 2011, and 2012. The entire amount was charged to expense in 2010. In addition, on December 31, 2011, fully depreciated machinery was sold for $6,400 cash, but the sale was not recorded until 2012. There were no other errors during 2010 or 2011, and no corrections have been made for any of the errors. Ignore income tax considerations. What is the total effect of the errors on 2011 net income?

A) Net income is understated by $12,800.

B) Net income is overstated by $3,600.

C) Net income is understated by $1,600.

D) Net income is overstated by $2,400.

Correct Answer:

Verified

Correct Answer:

Verified

Q8: Koppell Co. made the following errors in

Q9: Kentucky Enterprises purchased a machine on January

Q10: Which of the following should not be

Q11: On December 31, 2011, Prince Company appropriately

Q12: Which of the following, if discovered by

Q14: Coombs, Inc. is a calendar-year corporation whose

Q15: The ending inventory for Wattis Company was

Q16: Lambert Enterprises acquired Callahan Company for $700,000

Q17: Which of the following is not a

Q67: Which of the following is a counterbalancing