Multiple Choice

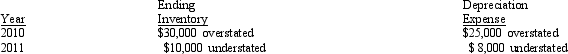

Coombs, Inc. is a calendar-year corporation whose financial statements for 2010 and 2011 included errors as follows:

Assume that purchases were recorded correctly and that no correcting entries were made at December 31, 2010, or December 31, 2011. Ignoring income taxes, by how much should Coombs's retained earnings be retroactively adjusted at January 1, 2012?

A) $27,000 increase

B) $27,000 decrease

C) $7,000 decrease

D) $3,000 decrease

Correct Answer:

Verified

Correct Answer:

Verified

Q9: Kentucky Enterprises purchased a machine on January

Q10: Which of the following should not be

Q11: On December 31, 2011, Prince Company appropriately

Q12: Which of the following, if discovered by

Q13: Rodney Company's December 31 year-end financial statements

Q15: The ending inventory for Wattis Company was

Q16: Lambert Enterprises acquired Callahan Company for $700,000

Q17: Which of the following is not a

Q19: Which of the following types of errors

Q67: Which of the following is a counterbalancing