Essay

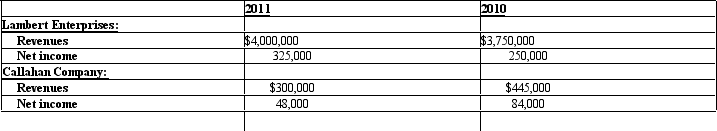

Lambert Enterprises acquired Callahan Company for $700,000 December 31, 2011. This amount exceeded the recorded value of Callahan Company's net assets by $150,000 on the acquisition date. The entire excess of cost over the book value of the net assets related to a piece of equipment owned by Callahan that had a remaining life of five years as of the acquisition date. The companies reported the following amounts for the 2010 and 2011:

Prepare the pro forma information for this acquisition required by SFAS No. 141.

Correct Answer:

Verified

The pro forma information required would...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q11: On December 31, 2011, Prince Company appropriately

Q12: Which of the following, if discovered by

Q13: Rodney Company's December 31 year-end financial statements

Q14: Coombs, Inc. is a calendar-year corporation whose

Q15: The ending inventory for Wattis Company was

Q17: Which of the following is not a

Q19: Which of the following types of errors

Q20: Which of the following isnot a change

Q21: The effect of a change in accounting

Q67: Which of the following is a counterbalancing