Multiple Choice

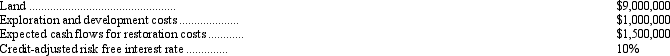

Joseph Company acquired a tract of land containing an extractable natural resource. Joseph is required by the purchase contract to restore the land to a condition suitable for recreational use after it has extracted the natural resource. Geological surveys estimate that the recoverable reserves will be 2,500,000 tons and that the extraction will be completed in five years. Relevant cost information follows:

What should be the depletion charge per ton of extracted material?

A) $4.00

B) $4.37

C) $3.97

D) $3.60

Correct Answer:

Verified

Correct Answer:

Verified

Q42: Which of the following depreciation methods is

Q47: The composite depreciation method<br>A) is applied to

Q63: Use-factor depreciation methods view asset consumption as

Q64: Johnson Company purchased equipment 8 years ago

Q65: Riley Company owns a machine that cost

Q68: Information needed to compute a depletion charge

Q69: On July 1, Phoenix Corporation, a calendar-year

Q70: On January 1, 2009, Kalos Co. purchased

Q71: Bunker Construction Company recently exchanged an old

Q72: Hendricks Construction purchased a crane on January