Essay

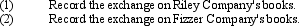

Riley Company owns a machine that cost $560,000, has a book value of $240,000, and an estimated fair value of $480,000. Fizzer Company has a machine that cost $720,000, has accumulated depreciation of $400,000, and an estimated fair value of $640,000. Riley pays Fizzer cash of $160,000. Assume the trade has commercial substance.

Correct Answer:

Verified

Correct Answer:

Verified

Q42: Which of the following depreciation methods is

Q60: Five years ago, Goodman, Inc., purchased a

Q61: A company owns a piece of land

Q61: Wilbur Company acquired Smith Company on January

Q63: Use-factor depreciation methods view asset consumption as

Q64: Johnson Company purchased equipment 8 years ago

Q68: Information needed to compute a depletion charge

Q68: Joseph Company acquired a tract of land

Q69: On July 1, Phoenix Corporation, a calendar-year

Q70: On January 1, 2009, Kalos Co. purchased