Multiple Choice

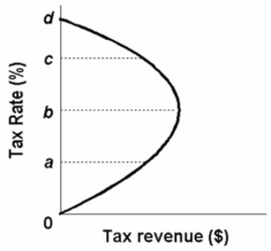

Refer to the above diagram.If tax rates are between b and d, then supply-side economists are of the opinion that a(n) :

Refer to the above diagram.If tax rates are between b and d, then supply-side economists are of the opinion that a(n) :

A) increase in tax revenues will increase tax rates.

B) decrease in tax rates will increase tax revenues.

C) increase in tax rates will increase tax revenues.

D) decrease in tax revenues will decrease tax rates.

Correct Answer:

Verified

Correct Answer:

Verified

Q58: If government uses its stabilization policies to

Q82: In terms of aggregate supply, the difference

Q83: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6686/.jpg" alt=" Refer to the

Q84: If the government attempts to maintain full

Q85: When the economy is experiencing cost-push inflation,

Q86: A rightward shift of The Phillips Curve

Q88: If prices and wages are flexible, a

Q89: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6686/.jpg" alt=" The above diagram

Q91: An ongoing economic growth causes continuous leftward

Q92: Assuming prices and wages are flexible, a