Multiple Choice

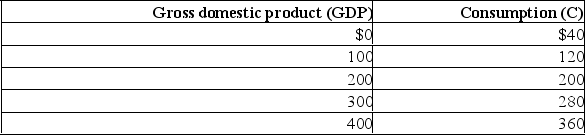

Refer to the above data.If a lump-sum tax (the same tax amount at each level of GDP) of $40 is imposed in this economy, the marginal propensity to consume is:

Refer to the above data.If a lump-sum tax (the same tax amount at each level of GDP) of $40 is imposed in this economy, the marginal propensity to consume is:

A) .8 before taxes and .6 after taxes.

B) .8 both before and after taxes.

C) .6 before taxes and .8 after taxes.

D) .8 before taxes and .4 after taxes.

Correct Answer:

Verified

Correct Answer:

Verified

Q182: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6686/.jpg" alt=" Refer to the

Q183: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6686/.jpg" alt=" Refer to the

Q184: Who among the following owned the smallest

Q185: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6686/.jpg" alt=" Refer to the

Q186: As a percent of GDP, Canada's public

Q188: An increase in taxes would be an

Q189: The greater the progressiveness of the tax

Q191: Other things equal, the stock of capital

Q191: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6686/.jpg" alt=" Refer to the

Q192: With a regressive tax system, as the