Multiple Choice

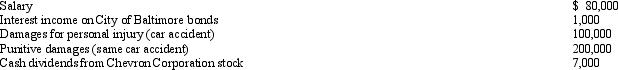

During 2013,Sarah had the following transactions:  Sarah's AGI is:

Sarah's AGI is:

A) $185,000.

B) $187,000.

C) $285,000.

D) $287,000.

E) $387,000.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q12: The exclusion of interest on educational savings

Q33: Child and dependent care expenses include amounts

Q99: The child tax credit is based on

Q109: Millie,age 80,is supported during the current year

Q110: Paul and Patty Black (both are age

Q111: Zeke made the following donations to qualified

Q112: In 2013,Theresa was in an automobile accident

Q117: Benjamin,age 16,is claimed as a dependent by

Q118: Sadie mailed a check for $2,200 to

Q119: Butch and Minerva are divorced in December