Essay

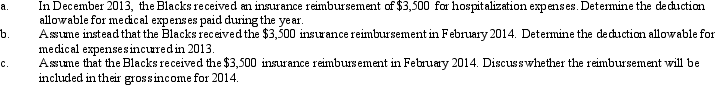

Paul and Patty Black (both are age 66)are married and together have AGI of $140,000 in 2013.They have two dependents and file a joint return.During the year,they paid $8,000 for medical insurance,$15,000 in doctor bills and hospital expenses,and $1,000 for prescribed medicine and drugs.

Correct Answer:

Verified

General discussion.All of the following ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q12: The exclusion of interest on educational savings

Q14: Ted earned $150,000 during the current year.

Q27: Edna had an accident while competing in

Q33: Child and dependent care expenses include amounts

Q72: When the kiddie tax applies, the child

Q107: When filing their Federal income tax returns,the

Q109: Millie,age 80,is supported during the current year

Q111: Zeke made the following donations to qualified

Q112: In 2013,Theresa was in an automobile accident

Q114: During 2013,Sarah had the following transactions: <img