Multiple Choice

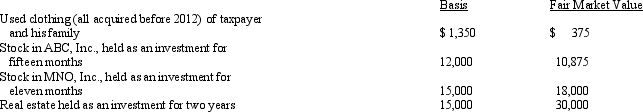

Zeke made the following donations to qualified charitable organizations during 2013:  The used clothing was donated to the Salvation Army; the other items of property were donated to Eastern State University.Both are qualified charitable organizations.Disregarding percentage limitations,Zeke's charitable contribution deduction for 2013 is:

The used clothing was donated to the Salvation Army; the other items of property were donated to Eastern State University.Both are qualified charitable organizations.Disregarding percentage limitations,Zeke's charitable contribution deduction for 2013 is:

A) $43,350.

B) $56,250.

C) $59,250.

D) $60,375.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q12: The exclusion of interest on educational savings

Q27: Edna had an accident while competing in

Q33: Child and dependent care expenses include amounts

Q72: When the kiddie tax applies, the child

Q99: The child tax credit is based on

Q107: When filing their Federal income tax returns,the

Q109: Millie,age 80,is supported during the current year

Q110: Paul and Patty Black (both are age

Q112: In 2013,Theresa was in an automobile accident

Q114: During 2013,Sarah had the following transactions: <img