Multiple Choice

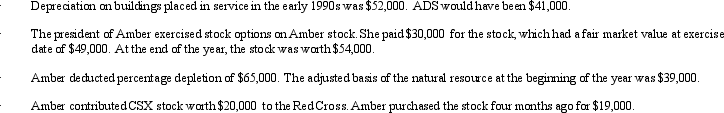

Amber,Inc.,has taxable income of $212,000.In addition,Amber accumulates the following information which may affect its AMT.  What is Amber's AMTI?

What is Amber's AMTI?

A) $212,000.

B) $233,000.

C) $238,000.

D) $249,000.

E) None of the above

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q7: A limited partner in a limited partnership

Q15: Only C corporations are subject to the

Q16: Albert and Elva each own 50% of

Q18: Daisy,Inc.,has taxable income of $850,000 during 2013,its

Q21: Lime, Inc., has taxable income of $334,000.

Q22: Doris is going to invest $90,000 in

Q56: Martin contributes property with an adjusted basis

Q99: What is the major pitfall associated with

Q121: Agnes owns a sole proprietorship for which

Q150: Which of the following special allocations are