Essay

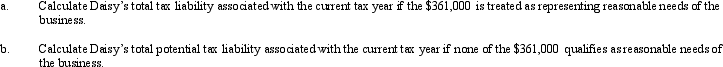

Daisy,Inc.,has taxable income of $850,000 during 2013,its first year of operations.Daisy distributes dividends of $200,000 to its 10 shareholders (i.e.,$20,000 each).Daisy earmarks $361,000 of its earnings for potential future expansion into other cities.

Correct Answer:

Verified

Correct Answer:

Verified

Q7: A limited partner in a limited partnership

Q15: Only C corporations are subject to the

Q16: Albert and Elva each own 50% of

Q17: Amber,Inc.,has taxable income of $212,000.In addition,Amber accumulates

Q22: Doris is going to invest $90,000 in

Q25: Fred and Ella are going to establish

Q56: Martin contributes property with an adjusted basis

Q99: What is the major pitfall associated with

Q121: Agnes owns a sole proprietorship for which

Q150: Which of the following special allocations are