Essay

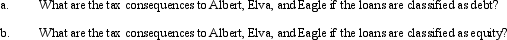

Albert and Elva each own 50% of the stock of Eagle,Inc.(a C corporation).To cover what is perceived as temporary working capital needs,each shareholder loans Eagle $200,000 with an annual interest rate of 6% (same as the Federal rate)and a maturity date of one year.The loan is made at the beginning of 2013.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Beige, Inc., has 3,000 shares of stock

Q7: A limited partner in a limited partnership

Q15: Only C corporations are subject to the

Q17: Amber,Inc.,has taxable income of $212,000.In addition,Amber accumulates

Q18: Daisy,Inc.,has taxable income of $850,000 during 2013,its

Q21: Lime, Inc., has taxable income of $334,000.

Q56: Martin contributes property with an adjusted basis

Q99: What is the major pitfall associated with

Q121: Agnes owns a sole proprietorship for which

Q150: Which of the following special allocations are