Multiple Choice

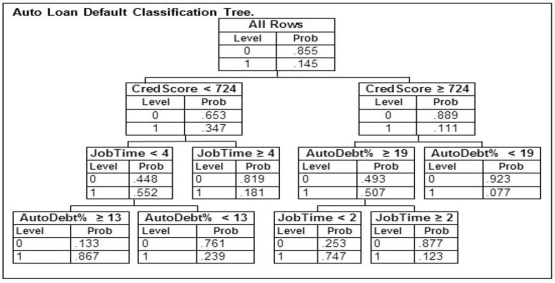

An automobile finance company analyzed a sample of recent automobile loans to try to determine key factors in identifying borrowers who would be likely to default on their auto loan. The response variable Default equals 1 if the borrower defaulted during the term of the loan and 0 otherwise. The predictor variable AutoDebt% was the ratio (expressed as a percent) of the required loan payments to the borrower's take-home income at the time of purchase. JobTime was the number of years the borrower had worked at their current job at the time of purchase. CredScore was the borrower's credit score at the time of purchase. Below is part of the classification tree the finance company derived from the data collected in the study. Assume they classify those with a default probability estimate of at least .5 as Defaulters.  Based on this classification tree, a member of the study sample who had a credit score of 667, been at their current job for 3 years, took out a loan with payments equaling 13% of their income, and did not default would be

Based on this classification tree, a member of the study sample who had a credit score of 667, been at their current job for 3 years, took out a loan with payments equaling 13% of their income, and did not default would be

A) inaccurately classified as a Defaulter.

B) inaccurately classified as a non-Defaulter.

C) accurately classified as a Defaulter.

D) accurately classified as a non-Defaulter.

Correct Answer:

Verified

Correct Answer:

Verified

Q43: An internet service provider (ISP) has randomly

Q44: Suppose that a bank wishes to predict

Q45: The nearest neighbors to an observation are

Q46: An automobile finance company analyzed a sample

Q47: An automobile finance company analyzed a sample

Q49: A classification tree is useful for predicting

Q50: The naive Bayes' classification procedure can be

Q51: An automobile finance company analyzed a sample

Q52: An automobile finance company analyzed a sample

Q53: The confusion matrix is not a good