Multiple Choice

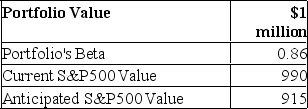

You are given the following information about a portfolio you are to manage.For the long term, you are bullish, but you think the market may fall over the next month.  If the anticipated market value materializes, what will be your expected loss on the portfolio?

If the anticipated market value materializes, what will be your expected loss on the portfolio?

A) 7.58%

B) 6.52%

C) 15.43%

D) 8.57%

Correct Answer:

Verified

Correct Answer:

Verified

Q25: A hedge ratio can be computed as<br>A)

Q27: Foreign exchange futures markets are _, and

Q28: Consider the following: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7045/.jpg" alt="Consider the

Q30: Credit risk in the swap market<br>A)is extensive.<br>B)is

Q31: Consider the following: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7045/.jpg" alt="Consider the

Q32: The value of a futures contract for

Q33: Which of the following is(are) example(s) of

Q35: The most common short-term interest rate used

Q37: If a stock index futures contract is

Q47: Which two indices had the lowest correlation