Multiple Choice

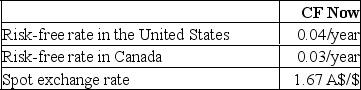

Consider the following:  Assume the current market futures price is 1.66 CAD$/$.You borrow 167,000 CAD$, convert the proceeds to U.S.dollars, and invest them in the U.S.at the risk-free rate.You simultaneously enter a contract to purchase 170,340 CAD$ at the current futures price (maturity of 1 year) .What would be your profit (loss) ?

Assume the current market futures price is 1.66 CAD$/$.You borrow 167,000 CAD$, convert the proceeds to U.S.dollars, and invest them in the U.S.at the risk-free rate.You simultaneously enter a contract to purchase 170,340 CAD$ at the current futures price (maturity of 1 year) .What would be your profit (loss) ?

A) Profit of 630 CAD$

B) Loss of 2300 CAD$

C) Profit of 2300 CAD$

D) Loss of 630 CAD$

Correct Answer:

Verified

Correct Answer:

Verified

Q12: Suppose that the risk-free rates in the

Q23: Which one of the following stock index

Q25: Consider the following: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7045/.jpg" alt="Consider the

Q26: You are given the following information about

Q27: Foreign exchange futures markets are _, and

Q30: Credit risk in the swap market<br>A)is extensive.<br>B)is

Q31: Consider the following: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7045/.jpg" alt="Consider the

Q32: The value of a futures contract for

Q32: You are given the following information about

Q33: Which of the following is(are) example(s) of