Multiple Choice

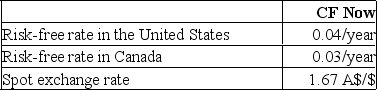

Consider the following:  If the market futures price is 1.69 A$/$, how could you arbitrage?

If the market futures price is 1.69 A$/$, how could you arbitrage?

A) Borrow Canadian dollars in Canada, convert them to dollars, lend the proceeds in the United States, and enter futures positions to purchase Canadian dollars at the current futures price.

B) Borrow U.S.dollars in the United States, convert them to Canadian dollars, lend the proceeds in Canada, and enter futures positions to sell Canadian dollars at the current futures price.

C) Borrow U.S.dollars in the United States, invest them in the U.S., and enter futures positions to purchase Canadian dollars at the current futures price.

D) Borrow Canadian dollars in Canada and invest them there, then convert back to U.S.dollars at the spot price.

Correct Answer:

Verified

Correct Answer:

Verified

Q25: A hedge ratio can be computed as<br>A)

Q26: You are given the following information about

Q27: Foreign exchange futures markets are _, and

Q28: Consider the following: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7045/.jpg" alt="Consider the

Q30: Credit risk in the swap market<br>A)is extensive.<br>B)is

Q32: The value of a futures contract for

Q32: You are given the following information about

Q33: Which of the following is(are) example(s) of

Q35: The most common short-term interest rate used

Q47: Which two indices had the lowest correlation