Multiple Choice

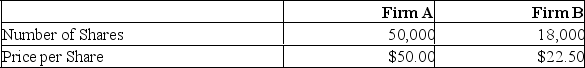

Suppose you have the following information concerning an acquiring firm (A) and a target firm (B) . Neither firm has any debt. The incremental value of the acquisition is estimated to be $250,000. Firm B is willing to be acquired for $540,000 worth of Firm A's stock.  What is the NPV of acquiring Firm B?

What is the NPV of acquiring Firm B?

A) The NPV is negative

B) $94,588

C) $102,120

D) $118,156

E) $162,015

Correct Answer:

Verified

Correct Answer:

Verified

Q3: Suppose General Motors buys up auto dealerships

Q4: Suppose Ford acquires General Motors. This is

Q5: Synergistic benefits can often be realized by

Q6: _ is a defensive tactic in which

Q9: Provide a definition of a split-up.

Q10: Firm B is willing to be acquired

Q11: For an acquisition to be tax-free, the

Q12: Provide a definition of an amalgamation.

Q13: Both firms are 100% equity-financed. Firm A

Q63: Which one of the following statements is