Multiple Choice

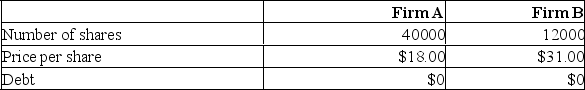

Firm B is willing to be acquired by firm A at a price of $34 a share in either cash or stock. The incremental value of the proposed acquisition is estimated at $80,000.  What is the NPV of acquiring firm B if the merger is an all cash deal?

What is the NPV of acquiring firm B if the merger is an all cash deal?

A) $36,000

B) $44,000

C) $80,000

D) $116,000

E) $128,000

Correct Answer:

Verified

Correct Answer:

Verified

Q5: Synergistic benefits can often be realized by

Q6: _ is a defensive tactic in which

Q8: Suppose you have the following information concerning

Q9: Provide a definition of a split-up.

Q11: For an acquisition to be tax-free, the

Q12: Provide a definition of an amalgamation.

Q13: Both firms are 100% equity-financed. Firm A

Q14: If the average cost per unit decreases

Q15: Provide a definition of a leveraged buyouts

Q63: Which one of the following statements is