Multiple Choice

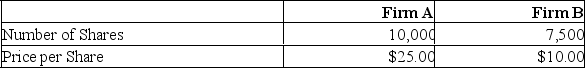

Both firms are 100% equity-financed. Firm A can acquire firm B for $82,500 in the form of either cash or stock. The synergy value of the deal is $12,500.  What is the cost of acquisition when stock financing is used?

What is the cost of acquisition when stock financing is used?

A) $75,126

B) $80,000

C) $81,555

D) $82,500

E) $83,754

Correct Answer:

Verified

Correct Answer:

Verified

Q8: Suppose you have the following information concerning

Q9: Provide a definition of a split-up.

Q10: Firm B is willing to be acquired

Q11: For an acquisition to be tax-free, the

Q12: Provide a definition of an amalgamation.

Q14: If the average cost per unit decreases

Q15: Provide a definition of a leveraged buyouts

Q16: Provide a definition of corporate governance.

Q17: Suppose you have the following information concerning

Q18: Weston Bakery and Early's Bakery are all-equity