Multiple Choice

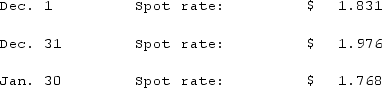

Clark Co., a U.S. corporation, sold inventory on December 1, 2021, with payment of 12,000 British pounds to be received in sixty days. The pertinent exchange rates were as follows:  What amount of foreign exchange gain or loss should be recorded on January 30?

What amount of foreign exchange gain or loss should be recorded on January 30?

A) $2,496 gain.

B) $2,496 loss.

C) $0.

D) $1,740 loss.

E) $1,740 gain.

Correct Answer:

Verified

Correct Answer:

Verified

Q15: A spot rate may be defined as<br>A)

Q16: A U.S. company sells merchandise to a

Q17: Coyote Corp. (a U.S. company in Texas)

Q18: Nelson Co. ordered parts costing §120,000 from

Q19: On December 1, 2021, Keenan Company, a

Q21: On March 1, 2021, Mattie Company received

Q22: To account for a forward contract cash

Q23: What happens when a U.S. company purchases

Q24: On May 1, 2021, Mosby Company received

Q25: What are the two separate transactions that