Multiple Choice

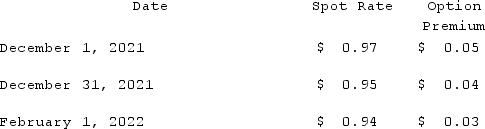

On December 1, 2021, Keenan Company, a U.S. firm, sold merchandise to Velez Company of Canada for 150,000 Canadian dollars (CAD) . Collection of the receivable is due on February 1, 2022. Keenan purchased a foreign currency put option with a strike price of $0.97 (U.S.) on December 1, 2021. This foreign currency option is designated as a cash flow hedge. Relevant exchange rates follow:  Compute the fair value of the foreign currency option at February 1, 2022.

Compute the fair value of the foreign currency option at February 1, 2022.

A) $6,000.

B) $4,500.

C) $3,000.

D) $7,500.

E) $1,500.

Correct Answer:

Verified

Correct Answer:

Verified

Q14: Which of the following approaches is used

Q15: A spot rate may be defined as<br>A)

Q16: A U.S. company sells merchandise to a

Q17: Coyote Corp. (a U.S. company in Texas)

Q18: Nelson Co. ordered parts costing §120,000 from

Q20: Clark Co., a U.S. corporation, sold inventory

Q21: On March 1, 2021, Mattie Company received

Q22: To account for a forward contract cash

Q23: What happens when a U.S. company purchases

Q24: On May 1, 2021, Mosby Company received