Multiple Choice

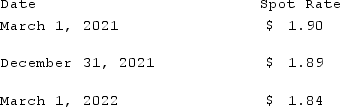

On March 1, 2021, Mattie Company received an order to sell a machine to a customer in England at a price of 200,000 British pounds. The machine was shipped and payment was received on March 1, 2022. On March 1, 2021, Mattie purchased a put option giving it the right to sell 200,000 British pounds on March 1, 2022 at a price of $380,000. Mattie properly designates the option as a fair hedge of the pound firm commitment. The option cost $2,000 and had a fair value of $2,200 on December 31, 2021. The following spot exchange rates apply:  Mattie's incremental borrowing rate is 12%, and the present value factor for two months at a 12% annual rate is 0.9803.What was the net impact on Mattie's 2022 income including the fair value hedge of a firm commitment?

Mattie's incremental borrowing rate is 12%, and the present value factor for two months at a 12% annual rate is 0.9803.What was the net impact on Mattie's 2022 income including the fair value hedge of a firm commitment?

A) $379,760.60 decrease.

B) $8,360.60 increase.

C) $8,360.60 decrease.

D) $4,390.40 decrease.

E) $379,760.60 increase.

Correct Answer:

Verified

Correct Answer:

Verified

Q16: A U.S. company sells merchandise to a

Q17: Coyote Corp. (a U.S. company in Texas)

Q18: Nelson Co. ordered parts costing §120,000 from

Q19: On December 1, 2021, Keenan Company, a

Q20: Clark Co., a U.S. corporation, sold inventory

Q22: To account for a forward contract cash

Q23: What happens when a U.S. company purchases

Q24: On May 1, 2021, Mosby Company received

Q25: What are the two separate transactions that

Q26: A U.S. company sells merchandise to a