Essay

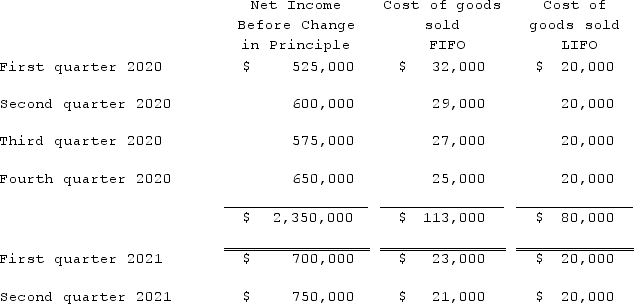

Harrison Company, Inc. began operations on January 1, 2020, and applied the LIFO method for inventory valuation. On June 10, 2021, Harrison adopted the FIFO method of accounting for inventory. Additional information is as follows:  The LIFO method was applied during the first quarter of 2021 and the FIFO method was applied during the second quarter of 2021 in computing income, above. Harrison's effective income tax rate is 40%. Harrison has 500,000 shares of common stock outstanding at all times.Compute the after-tax effect of Harrison's change in inventory method.

The LIFO method was applied during the first quarter of 2021 and the FIFO method was applied during the second quarter of 2021 in computing income, above. Harrison's effective income tax rate is 40%. Harrison has 500,000 shares of common stock outstanding at all times.Compute the after-tax effect of Harrison's change in inventory method.

Correct Answer:

Verified

Correct Answer:

Verified

Q110: Betsy Kirkland, Inc. incurred a flood loss

Q111: Baker Corporation changed from the LIFO method

Q112: Cement Company, Inc. began the first quarter

Q113: How should seasonal revenues be reported in

Q114: Peterson Corporation has three operating segments with

Q115: Nigel Corp. had six different operating segments

Q116: The following information for Urbanski Corporation relates

Q117: Harrison Company, Inc. began operations on January

Q118: What related items need to be disclosed

Q119: According to International Financial Reporting Standards (IFRS),