Multiple Choice

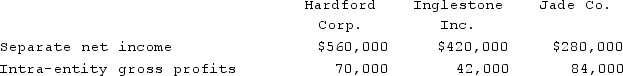

Hardford Corp. held 80% of Inglestone Inc., which, in turn, owned 80% of Jade Co. Excess amortization expense was not required by any of these acquisitions. Separate net income figures (without investment income) as well as upstream intra-entity gross profits (before deferral) included in the income for the current year follow:  The accrual-based net income of Jade Co. is calculated to be

The accrual-based net income of Jade Co. is calculated to be

A) $193,000.

B) $189,000.

C) $196,000.

D) $201,000.

E) $144,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q2: Reggie, Inc. owns 70% of Nancy Corporation.

Q3: Kurton Inc. owned 90% of Luvyn Corp.'s

Q4: For each of the following situations, select

Q5: For each of the following situations, select

Q6: Gardner Corp. owns 80% of the voting

Q7: Chase Company owns 80% of Lawrence Company

Q8: Woof Co. acquired all of Meow Co.

Q9: Hardford Corp. held 80% of Inglestone Inc.,

Q10: Paris, Inc. owns 80% of the voting

Q11: On January 1, 2020, Mace Co. acquired