Multiple Choice

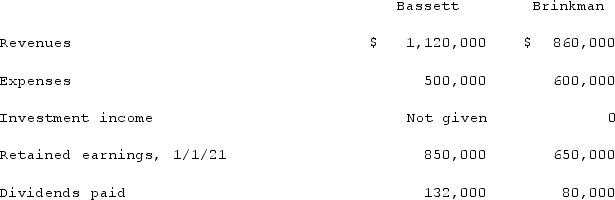

Bassett Inc. acquired all of the outstanding common stock of Brinkman Corp. on January 1, 2019, for $422,000. Equipment with a ten-year life was undervalued on Brinkman's financial records by $48,000. Brinkman also owned an unrecorded customer list with an assessed fair value of $71,000 and an estimated remaining life of five years.Brinkman earned reported net income of $185,000 in 2019 and $226,000 in 2020. Dividends of $75,000 were paid in each of these two years. Selected account balances as of December 31, 2021, for the two companies follow.  If the equity method had been applied, what would be the Investment in Brinkman Corp. account balance within the records of Bassett at the end of 2021?

If the equity method had been applied, what would be the Investment in Brinkman Corp. account balance within the records of Bassett at the end of 2021?

A) $806,000.

B) $811,000.

C) $863,000.

D) $920,000.

E) $1,036,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q113: Jackson Company acquires 100% of the stock

Q114: On January 1, 2019, Rand Corp. issued

Q115: Harrison, Inc. acquires 100% of the voting

Q116: On January 1, 2020, Barber Corp. paid

Q117: Pritchett Company recently acquired three businesses, recognizing

Q118: With respect to the recognition of goodwill

Q119: Hanson Co. acquired all of the common

Q121: Fesler Inc. acquired all of the outstanding

Q122: Scott Co. paid $2,800,000 to acquire all

Q123: Jackson Company acquires 100% of the stock