Multiple Choice

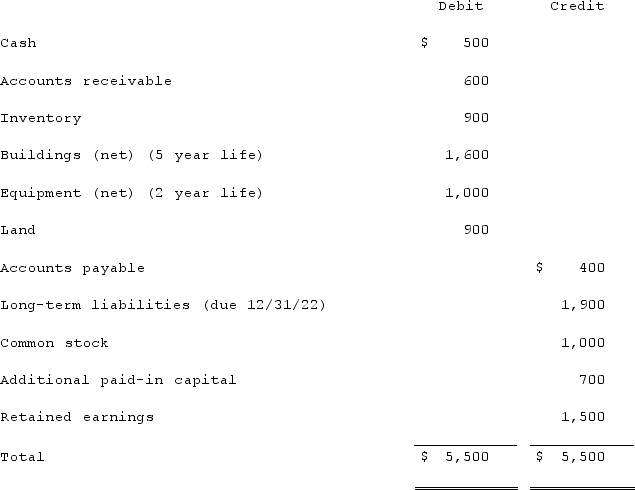

Jackson Company acquires 100% of the stock of Clark Corporation on January 1, 2020, for $4,100 cash. As of that date Clark has the following trial balance:  Net income and dividends reported by Clark for 2020 and 2021 follow:

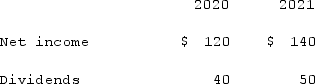

Net income and dividends reported by Clark for 2020 and 2021 follow:  The fair value of Clark's net assets that differ from their book values are listed below:

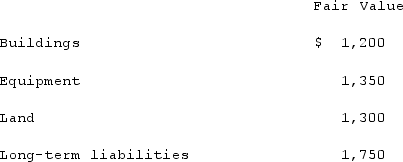

The fair value of Clark's net assets that differ from their book values are listed below:  Any excess of consideration transferred over fair value of net assets acquired is considered goodwill with an indefinite life.Compute the amount of Clark's long-term liabilities that would be reported in a December 31, 2020, consolidated balance sheet.

Any excess of consideration transferred over fair value of net assets acquired is considered goodwill with an indefinite life.Compute the amount of Clark's long-term liabilities that would be reported in a December 31, 2020, consolidated balance sheet.

A) $1,700.

B) $1,750.

C) $1,800.

D) $1,850.

E) $1,900.

Correct Answer:

Verified

Correct Answer:

Verified

Q113: Jackson Company acquires 100% of the stock

Q114: On January 1, 2019, Rand Corp. issued

Q115: Harrison, Inc. acquires 100% of the voting

Q116: On January 1, 2020, Barber Corp. paid

Q117: Pritchett Company recently acquired three businesses, recognizing

Q118: With respect to the recognition of goodwill

Q119: Hanson Co. acquired all of the common

Q120: Bassett Inc. acquired all of the outstanding

Q121: Fesler Inc. acquired all of the outstanding

Q122: Scott Co. paid $2,800,000 to acquire all