Multiple Choice

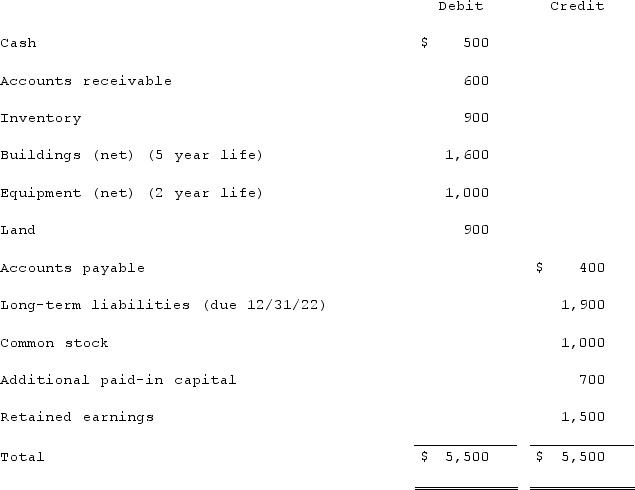

Jackson Company acquires 100% of the stock of Clark Corporation on January 1, 2020, for $4,100 cash. As of that date Clark has the following trial balance:  Net income and dividends reported by Clark for 2020 and 2021 follow:

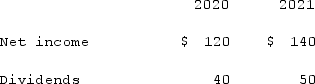

Net income and dividends reported by Clark for 2020 and 2021 follow:  The fair value of Clark's net assets that differ from their book values are listed below:

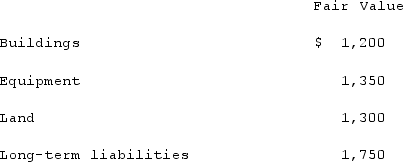

The fair value of Clark's net assets that differ from their book values are listed below:  Any excess of consideration transferred over fair value of net assets acquired is considered goodwill with an indefinite life.Compute the amount of Clark's buildings that would be reported in a December 31, 2020, consolidated balance sheet.

Any excess of consideration transferred over fair value of net assets acquired is considered goodwill with an indefinite life.Compute the amount of Clark's buildings that would be reported in a December 31, 2020, consolidated balance sheet.

A) $1,200.

B) $1,280.

C) $1,520.

D) $1,600.

E) $1,680.

Correct Answer:

Verified

Correct Answer:

Verified

Q20: Following are selected accounts for Green Corporation

Q21: Vaughn Inc. acquired all of the outstanding

Q22: Jaynes Inc. acquired all of Aaron Co.'s

Q23: Watkins, Inc. acquires all of the outstanding

Q24: How does the partial equity method differ

Q26: How is the fair value allocation of

Q27: Utah Inc. acquired all of the outstanding

Q28: Jaynes Inc. acquired all of Aaron Co.'s

Q29: On 1/1/19, Sey Mold Corporation acquired 100%

Q30: Kaye Company acquired 100% of Fiore Company