Multiple Choice

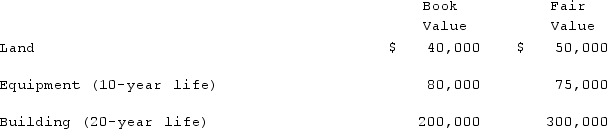

Watkins, Inc. acquires all of the outstanding stock of Glen Corporation on January 1, 2020. At that date, Glen owns only three assets and has no liabilities:  If Watkins pays $450,000 in cash for Glen, what amount would be represented as the subsidiary's Building in a consolidation at December 31, 2022, assuming the book value of the building at that date is still $200,000?

If Watkins pays $450,000 in cash for Glen, what amount would be represented as the subsidiary's Building in a consolidation at December 31, 2022, assuming the book value of the building at that date is still $200,000?

A) $200,000.

B) $285,000.

C) $290,000.

D) $295,000.

E) $300,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q14: Fesler Inc. acquired all of the outstanding

Q15: When is a goodwill impairment loss recognized?<br>A)

Q16: Scott Co. paid $2,800,000 to acquire all

Q17: Jackson Company acquires 100% of the stock

Q18: Avery Company acquires Billings Company in a

Q20: Following are selected accounts for Green Corporation

Q21: Vaughn Inc. acquired all of the outstanding

Q22: Jaynes Inc. acquired all of Aaron Co.'s

Q23: Watkins, Inc. acquires all of the outstanding

Q24: How does the partial equity method differ