Multiple Choice

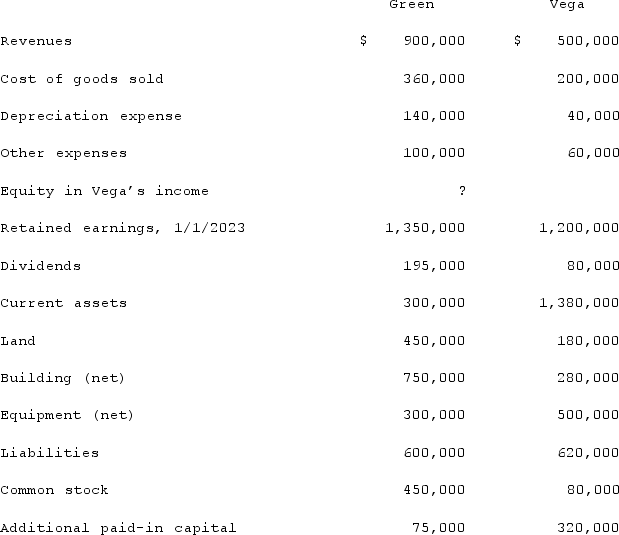

Following are selected accounts for Green Corporation and Vega Company as of December 31, 2023. Several of Green's accounts have been omitted.  Green acquired 100% of Vega on January 1, 2019, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2019, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment.Compute the December 31, 2023, consolidated equipment.

Green acquired 100% of Vega on January 1, 2019, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2019, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment.Compute the December 31, 2023, consolidated equipment.

A) $800,000.

B) $808,000.

C) $840,000.

D) $760,000.

E) $848,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q15: When is a goodwill impairment loss recognized?<br>A)

Q16: Scott Co. paid $2,800,000 to acquire all

Q17: Jackson Company acquires 100% of the stock

Q18: Avery Company acquires Billings Company in a

Q19: Watkins, Inc. acquires all of the outstanding

Q21: Vaughn Inc. acquired all of the outstanding

Q22: Jaynes Inc. acquired all of Aaron Co.'s

Q23: Watkins, Inc. acquires all of the outstanding

Q24: How does the partial equity method differ

Q25: Jackson Company acquires 100% of the stock