Essay

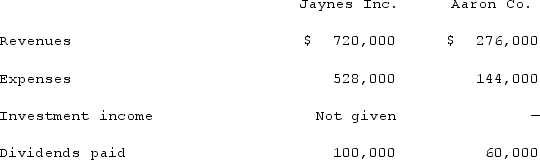

Jaynes Inc. acquired all of Aaron Co.'s common stock on January 1, 2020, by issuing 11,000 shares of $1 par value common stock. Jaynes' shares had a $17 per share fair value. On that date, Aaron reported a net book value of $120,000. However, its equipment (with a five-year remaining life) was undervalued by $6,000 in the company's accounting records. Any excess of consideration transferred over fair value of assets and liabilities acquired is assigned to an unrecorded patent to be amortized over ten years.The following figures came from the individual accounting records of these two companies as of December 31, 2020:  The following figures came from the individual accounting records of these two companies as of December 31, 2021:

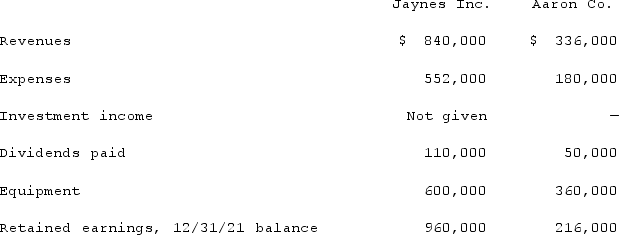

The following figures came from the individual accounting records of these two companies as of December 31, 2021:  What was the total for consolidated patents as of December 31, 2021?

What was the total for consolidated patents as of December 31, 2021?

Correct Answer:

Verified

Correct Answer:

Verified

Q17: Jackson Company acquires 100% of the stock

Q18: Avery Company acquires Billings Company in a

Q19: Watkins, Inc. acquires all of the outstanding

Q20: Following are selected accounts for Green Corporation

Q21: Vaughn Inc. acquired all of the outstanding

Q23: Watkins, Inc. acquires all of the outstanding

Q24: How does the partial equity method differ

Q25: Jackson Company acquires 100% of the stock

Q26: How is the fair value allocation of

Q27: Utah Inc. acquired all of the outstanding