Multiple Choice

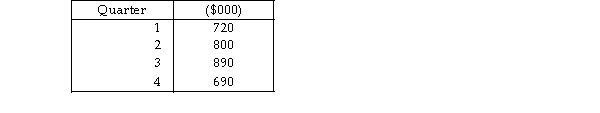

Musk L. Flexor owns a hot tub store that is experiencing significant growth. Flexor is trying to decide whether to expand its capacity, which currently is at $750,000 in sales per quarter. He is thinking about expanding to the $850,000 level. The before- tax profit from additional sales is 20 percent. Sales are seasonal, with peaks in the spring and summer quarters. Forecasts of capacity requirements, expressed in sales per quarter, for next year (year 2) are:

Demand in year 3 and beyond is expected to exceed $850,000 per quarter. Flexor is considering expansion at the end of the fourth quarter of this year (year 1) . How much would before- tax profits in year 2 increase because of this expansion?

A) less than $28,000

B) more than $28,000 but less than $32,000

C) more than $32,000 but less than $36,000

D) more than $36,000

Correct Answer:

Verified

Correct Answer:

Verified

Q90: Which one of the following factors usually

Q91: Give four principal reasons why economies of

Q92: The maximum output that can reasonably be

Q93: Many alternative strategies are available for the

Q94: If a system is well balanced, which

Q96: Larry's Wickets, Inc. is producing two types

Q97: Table 5.2<br>High Tech, Inc. is producing two

Q98: Diseconomies of scale refers to situations where

Q99: Which one of the following statements about

Q100: The _ time for a specific item