Multiple Choice

In the AD partnership, Allen's capital is $140,000 and Daniel's is $40,000 and they share income in a 3:1 ratio, respectively. They decide to admit David to the partnership. Each of the following question is independent of the others.

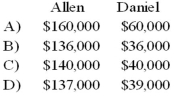

Refer to the information provided above. David invests $40,000 for a one-fifth interest in the total capital of $220,000. What are the capital balances of Allen and Daniel after David is admitted into the partnership?

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Correct Answer:

Verified

Q20: RD formed a partnership on February 10,

Q21: The DEF partnership reported net income of

Q23: The JPB partnership reported net income of

Q27: Two sole proprietors, L and M, agreed

Q29: Note: This is a Kaplan CPA Review

Q30: In the RST partnership, Ron's capital is

Q41: Paul and Ray sell musical instruments through

Q50: The partnership of X and Y shares

Q52: The ABC partnership had net income of

Q68: When a new partner is admitted into